Should I Buy Tesla Stock?

“[Elon Musk’s] big idea is that in Tesla he can make electric cars really work. That they can outperform their gas-guzzling cousins; that they can out-style them; out-tech them; save customers billions of dollars a year on gasoline, and in so doing save the world from itself.” – Tim Higgins

Disclaimer: None of the following is financial advice. Do your own research before making any investment.

Table of Contents

- Tesla's History

- Automobile Sales Landscape

- Tesla's Business Model

- Unique Advantages

- Cost Advantages

- Manufacturing Advantages

- Flexibility

- Trillion-Dollar S-Curves

- Price Prediction (Paid)

- Risks (Paid)

Tesla's History

“[Elon Musk’s] big idea is that in Tesla he can make electric cars really work. That they can outperform their gas-guzzling cousins; that they can out-style them; out-tech them; save customers billions of dollars a year on gasoline, and in so doing save the world from itself.” – Tim Higgins

- 2003 Tesla is founded by Martin Eberhard and Marc Tarpenning.

- 2004 Elon Musk invests in Tesla and becomes chairman of the board

- 2006 Elon Musk releases The Secret Tesla Motors Master Plan

- 2008 Tesla Roadster deliveries begin

- 2008 Tesla almost goes bankrupt (Recessions are difficult for car manufacturers)

- 2009 Tesla got Panasonic to supply batteries – just in time for the Model S

- 2010 Tesla opens the Fremont Factory

- 2012 Model S sedan deliveries begin

- 2015 Model X SUV deliveries begin

- 2016 Elon Musk releases Tesla's Master Plan, Part Deux

- 2016 Tesla opens Gigafactory Nevada

- 2017 Tesla opens Gigafactory New York

- 2017 Model 3 sedan deliveries begin

- 2019 Tesla almost goes bankrupt again (Ramping production is difficult)

- 2019 Tesla opens Gigafactory Shanghai

- 2020 Model Y SUV deliveries begin

- 2021 Tesla delivers 936,172 vehicles

- 2022 Gigafactory Berlin and Gigafactory Texas are scheduled to open

Automobile Sales Landscape

The process of manufacturing electric or gas-powered cars is brutal and expensive. Automakers typically take 5-7 years from the start of designing a new vehicle and delivering it to customers. It’s a tedious process that involves finding and fixing thousands of problems.

All of this effort typically results in a low-margin product. Meaning the vehicle manufacturer doesn't make much profit from selling the car. The average car only generates $2,800 in operating profit. And this level of profit margin requires an extraordinary scale—about 5,000 cars per week. Even if a manufacturer accomplishes all of that, they have to make sure there’s enough demand to sell them.

No new car manufacturer has succeeded in the US since Chrysler in 1925, until Tesla. And only 2 US car companies have ever not gone bankrupt: Ford and Tesla.

Competition

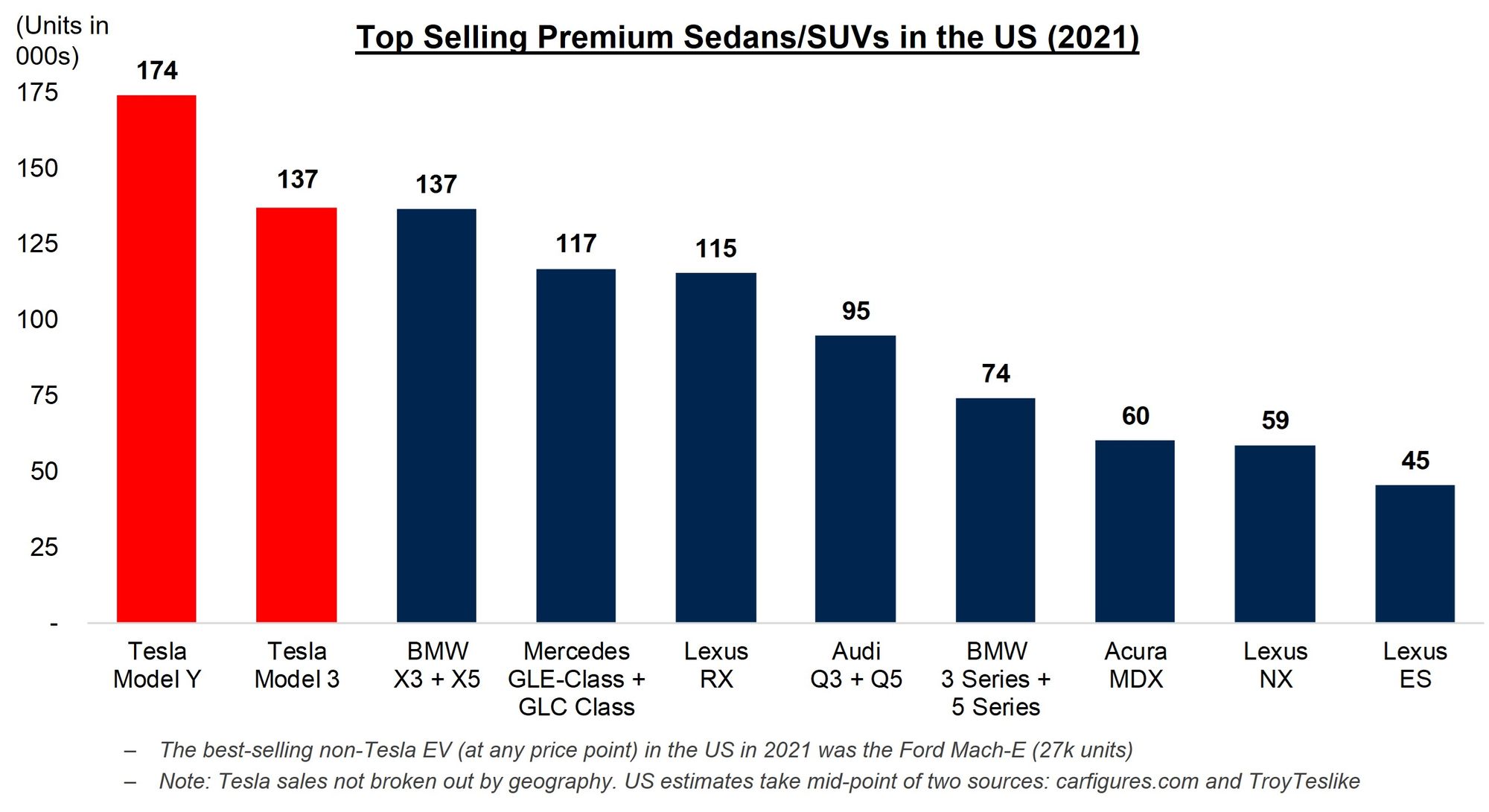

Tesla's competition is not other EV manufacturers, it is gas vehicle manufacturers. Electric vehicles only account for about 7% of new car sales. The target market is, in theory, as large as the gas-powered market. This means that EVs are not competing with other EVs – there is enough room for many EV manufacturers to thrive. Rather, all EV manufacturers are competing with all gas-powered manufacturers for the same market.

Tesla will easily steal market share from gas-powered vehicle manufacturers if they reduce prices. Demand increases dramatically with lower prices. (Tesla will greatly reduce the cost of their vehicles in the future because of declining battery costs – more on this later.)

Even if EV competition increases in the coming years, Tesla will have no demand problems because the EV market is taking previous gas-powered car customers. There is ample room for multiple electric vehicle manufacturers.

Traditional Car Manufacturers

What about when traditional car manufacturers, like Ford and GM, start investing in electric vehicles? Could they beat Tesla? After all, they have generations of experience in making cars, right?

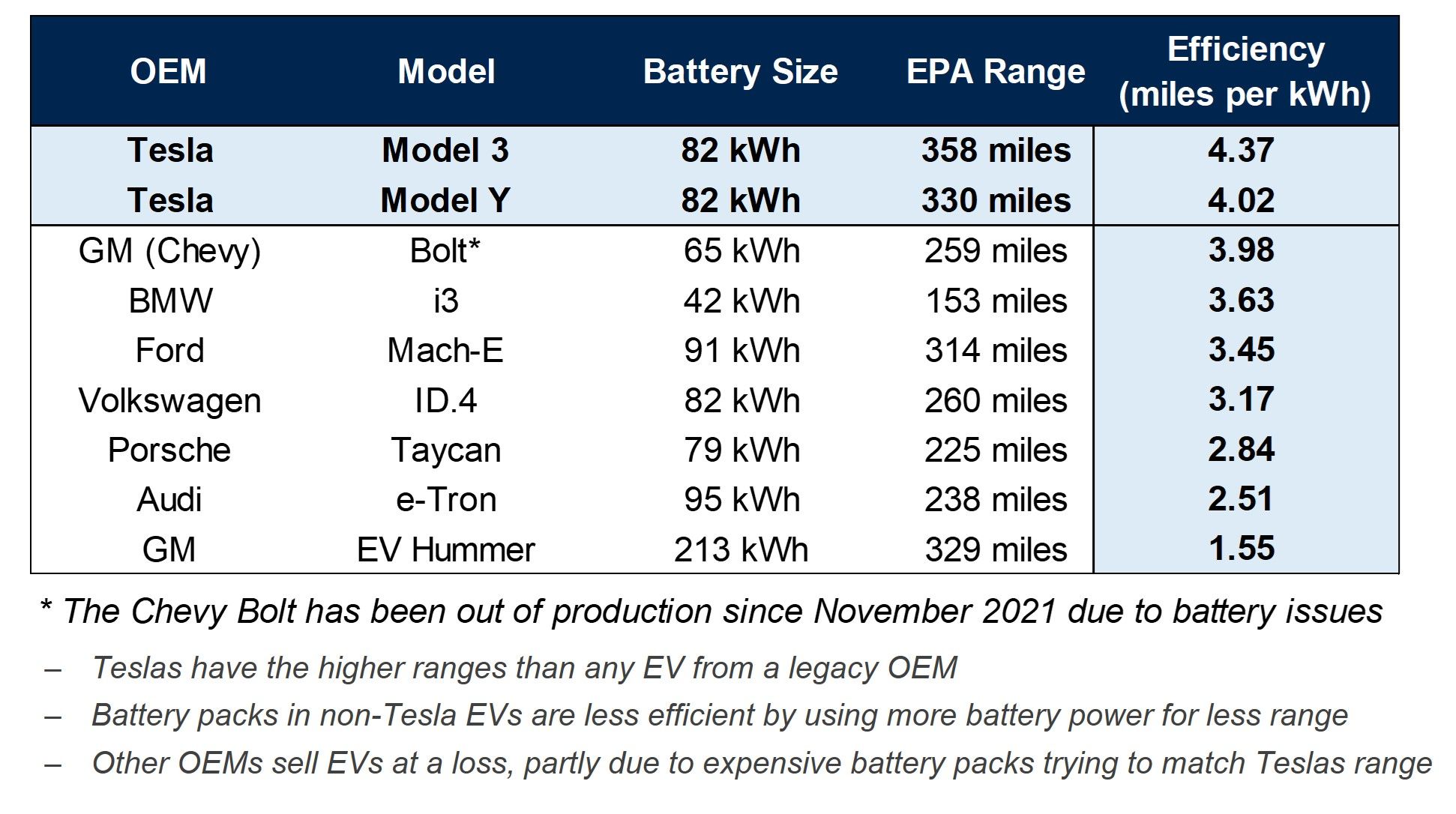

In short, no. Ford and GM are already making electric vehicles. They lose money on every electric vehicle they sell. They make few electric vehicles per year – similar to Tesla's production in 2014 or 2015 (7-8 years behind Tesla). And their technology (especially their battery technology) is about 3-5 years behind Tesla.

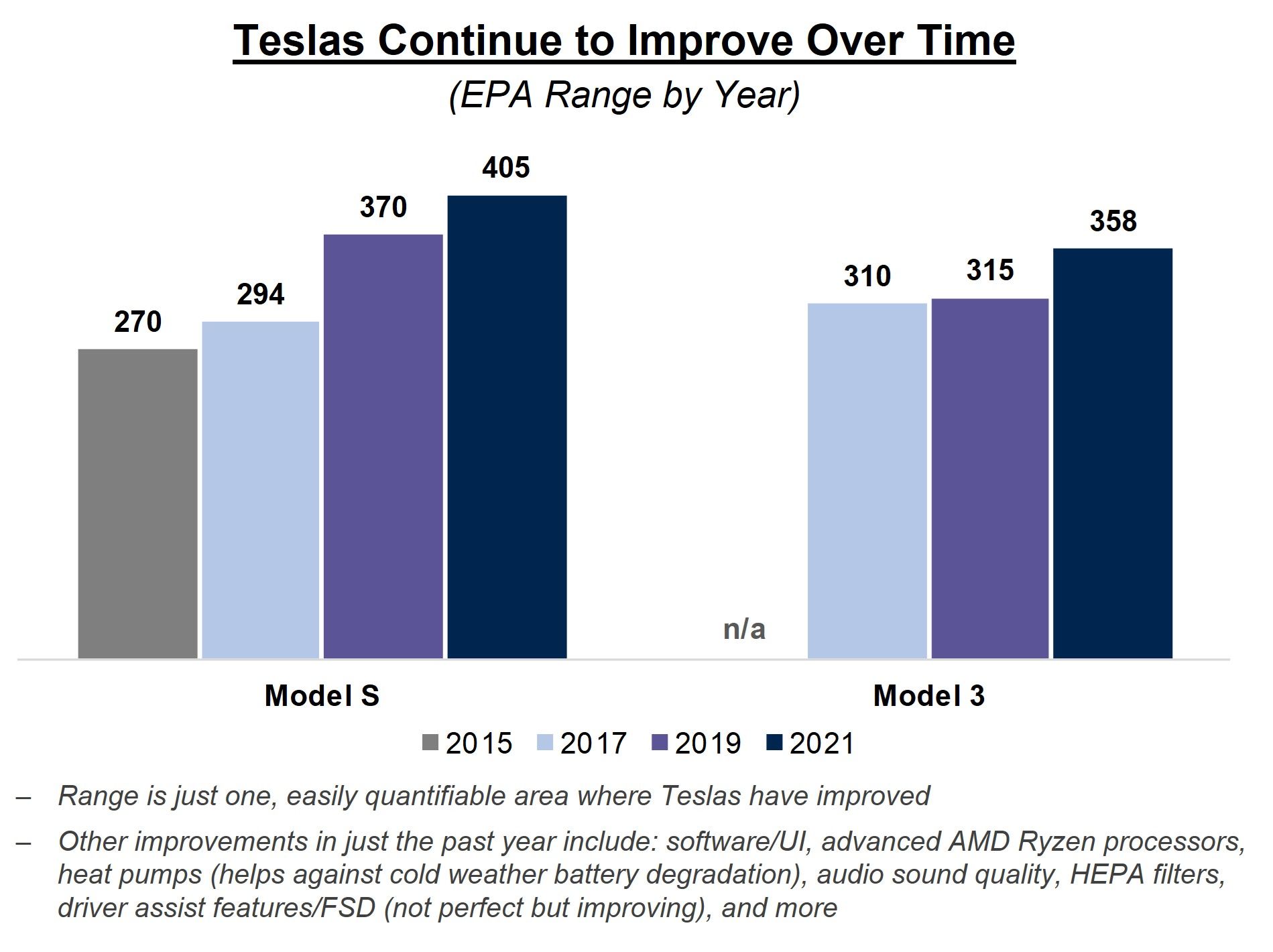

Moreover, Tesla is not a static target. Meaning, Tesla continues to innovate and improve, increasing the gap between themselves and their competition. Figure X below shows that Tesla's range improves nearly every year.

Traditional car manufacturers face a big problem. They are competing with themselves. If their EV efforts are successful, they are killing the gas-powered side of their business. For example, Ford recently announced the F-150 Lightning, an electric version of their popular truck. If the F-150 Lightning is better than an F-150, they will cannibalize their demand for the regular F-150.

Moreover, their gas-powered part of the business has bureaucracy and unions. This will make layoffs and the transition to electric exceedingly difficult for traditional car manufacturers. New startups, like Rivian and Lucid, don't have these problems.

Many traditional companies have employees and board members who are skeptical of electric vehicles. This will make a full investment in EV engineering difficult.

Traditional car manufacturers have no experience making electric vehicles. GM had to stop production of the Bolt EV in 2021 due to battery problems. Similar challenges await all other traditional car manufacturers as they try to scale production.

Chinese Electric Vehicle Manufacturers

From my analysis, Chinese EV manufacturers, such as Nio, are some of Tesla's best potential competitors. I use the word "potential" because the number of cars they make a year is currently at the level Tesla was at in 2016-2017, meaning they are roughly 5-6 years behind Tesla in production capabilities. Xpeng had slightly higher deliveries in 2021, totaling about 100,000, on par with Tesla in 2017.

But, as stated earlier, all EV manufacturers are really competing with traditional gas-powered cars for the same market, rather than with each other.

Tesla's Business Model

Tesla's current business model revolves almost entirely around car sales and Full Self Driving (FSD). FSD is a $12,000 software option that helps drive the car. The software is currently incomplete but nets Tesla a lot of profit.

Tesla historically has made a lot of money by selling zero-emission credits to other auto manufacturers. This income will decrease over time and their vehicle revenue will increase over time.

The competition of FSD could radically change Tesla's business model. They would shift to an Uber-like ride-hailing business model.

Tesla also sells energy products, like their solar panel roofs and power walls. I'm not going to get into Tesla's solar roof or power wall because they do not make up a large portion of Tesla's business at the moment. But Elon has said that around 2030, Tesla's energy side of the business could be larger than the EV side of the business.

Tesla Master Plan Part 1 (2006):

- Develop a sports car: 2008 Roadster

- Use that money to develop a more affordable car: Model S and X

- Use that money to develop an even more affordable car: Model 3 and Y

- Also provide zero-emission electric power products: Tesla Solar

Tesla Master Plan Part 2 (2016):

- Develop sleek solar roof and home battery energy storage: Tesla Roof and Powerwall

- Develop vehicles for all major markets: Model 3, Model Y, Cybertruck (in progress), and Semi (in progress)

- Develop autonomous driving software: FSD Beta (in progress)

- Develop an Uber-like ride-hailing service: Robotaxi (in progress)

Unique Advantages

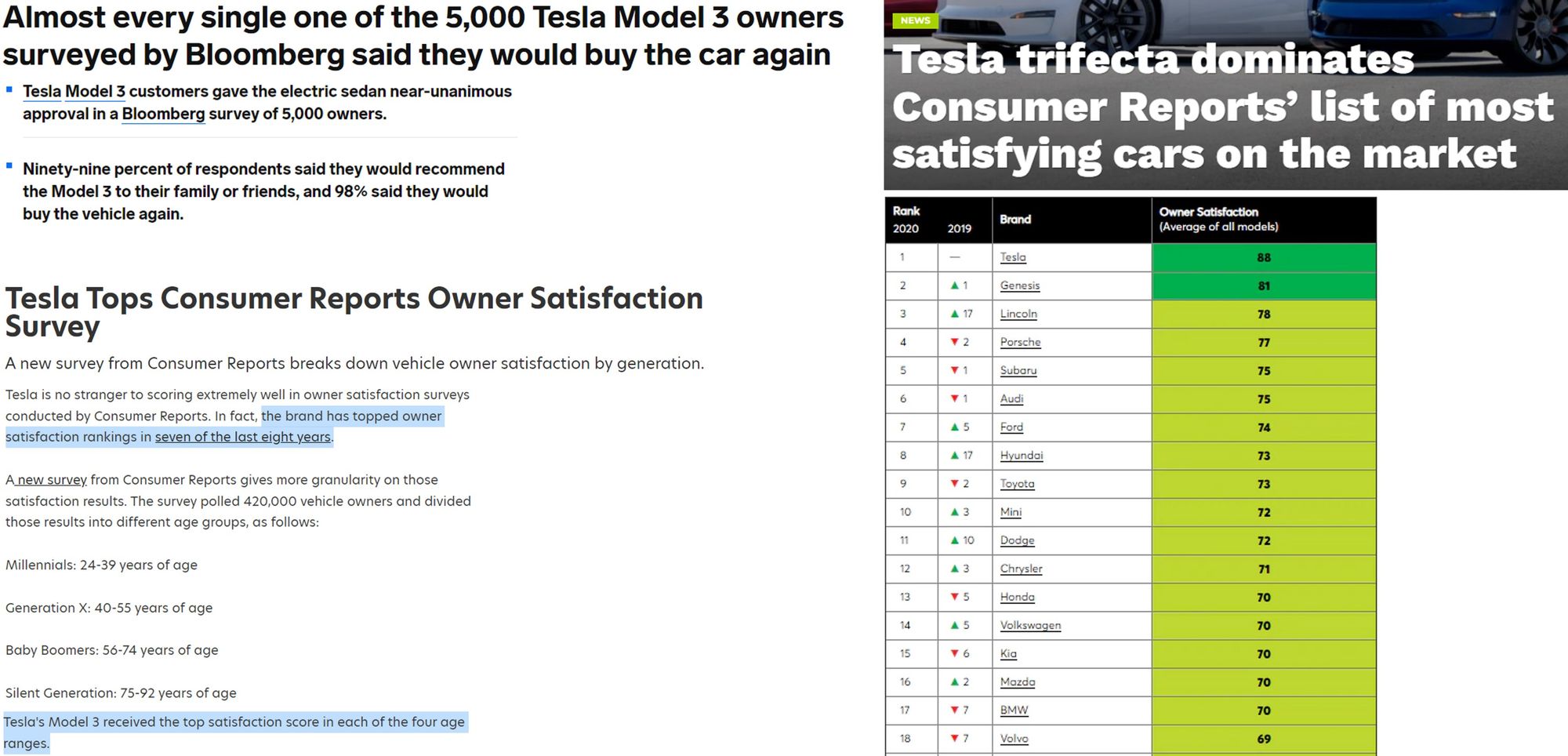

Tesla is the most popular brand of vehicle. They have the highest satisfaction rating of any vehicle. They don't do any paid advertising; instead, relying on word-of-mouth. They can do this because the product is noticeably different and superior.

Software

Tesla has the best software of any vehicle manufacturer. And it's not just me who thinks this: The CEO of Aptiv (the largest car software supplier) said, "...with exception to [Tesla] virtually all the OEMs that we are doing business with are struggling with software development." You can test this for yourself: go test drive a Tesla and compare its software interface with your car.

Autopilot and Full Self Driving

Tesla's full self-driving (FSD) is fundamentally unlike any competitor's. Most, if not all, of Tesla's FSD competition, uses LiDar – an expensive sensor that tells the car when there is something in front of it. LiDar is a crutch that is not only unnecessary, but it is also a hindrance. LiDar is prohibitively expensive, costing around $100,000 per sensor. This would take the cost of a $50,000 car to $150,000.

LiDar is used in conjunction with cameras. LiDar = more info. Isn't more info better? Not in this case. LiDar periodically gives the system conflicting information. If the LiDar says there's something in the road but the cameras say there's not, what should the autopilot do? This is the dilemma that plagues all LiDar-using autonomous car companies.

Tesla uses a vision-only approach to its autonomous driving system. A system that obviously works because humans also use vision-only while driving.

Each Tesla car is equipped with 8 cameras that surround the body of the car. This allows the car to see 360 degrees and 50-250 meters in every direction.

Many people think that FSD will take many more years and possibly even decades before it will be able to drive without human assistance. But I believe that FSD will be completed sooner than most people think.

All artificial intelligence (AI) projects are exponential in nature. They require immense computing power to run simulations to train the AI. Tesla

Tesla created Dojo, the most powerful neural net training computer in the world.

Only Tesla has the data to train neural nets to achieve level 5 autonomy. And once level 5 autonomy is reached, only Tesla will have the fleet size necessary to create an autonomous ride-hailing network. Due to Tesla's foresight, they equipped every Tesla since 2017 with the cameras and computer necessary to drive itself. This allowed them to collect WAY more data than their competitors and have WAY more vehicles that can be used autonomously.

All self-driving software needs 2 things to improve:

- Lots of data with high variability and edge cases – all weather conditions, blue stop signs, all kinds of sun flares obscuring the camera. This trains the software to work in extreme conditions. You get large amounts of data by having a large vehicle fleet equipped with cameras. Tesla has the largest fleet of cars

- Supercomputers to process the data. Tesla recently developed Dojo, their custom supercomputer designed specifically for developing AI software.

Solving AI problems requires vast amounts of data. Without getting too technical, the company that has data to train their computer simulations (neural nets) will solve the problem first. In short, Tesla will be the first to develop a level 5 fully self-driving car software because they have much more data than their competition.

Over the Air Updates

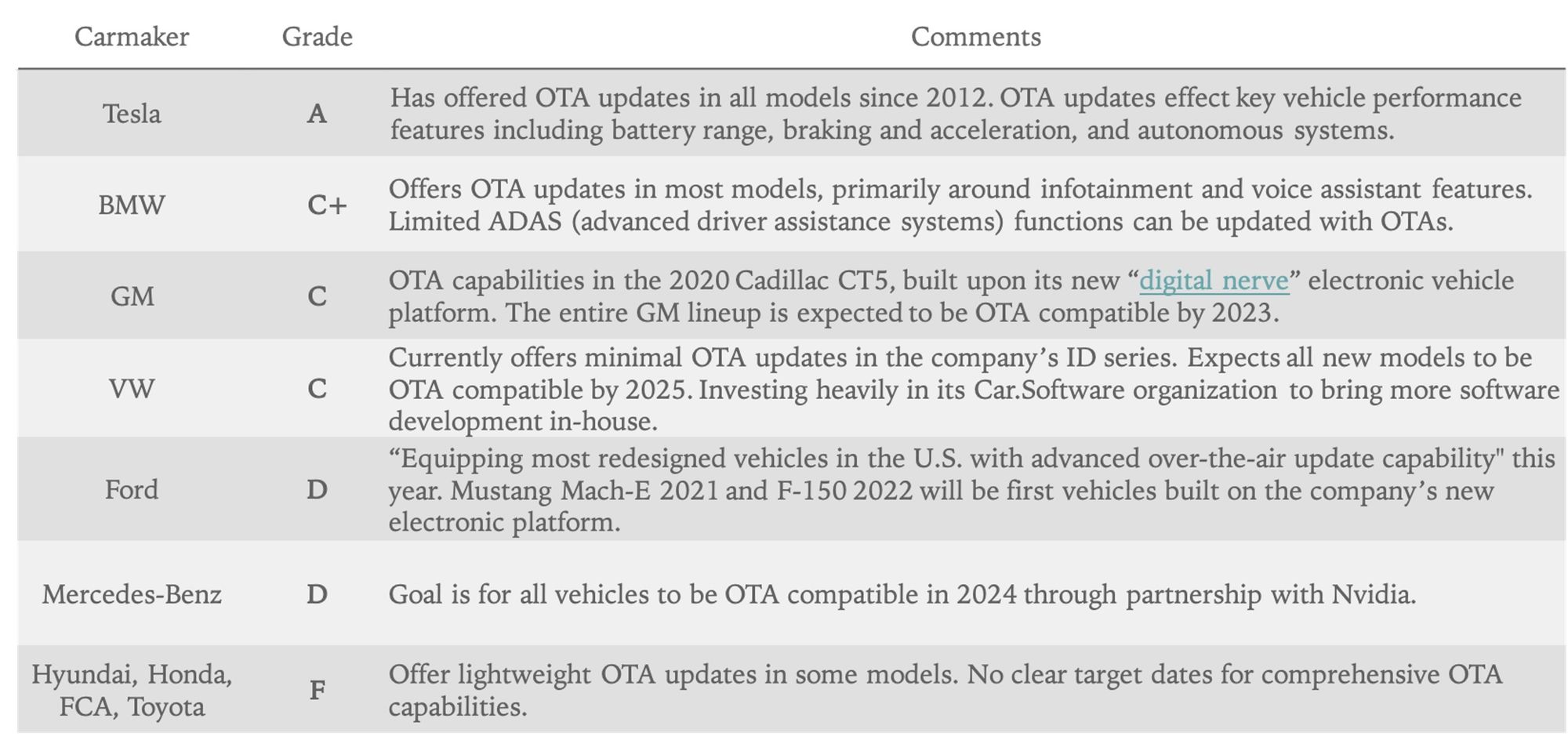

All Tesla's have best-in-class over the air (OTA) updates. These updates can improve performance, improve software interface, and solve recall issues.

Many OTA updates have been sent out that improve the 0-60 time and range of Tesla's vehicles.

The Tesla software interface and autopilot/FSD can be updated with OTA updates.

Even recall issues can often be solved with OTA updates. If a part was wearing out, an OTA update could be sent out that changes the torque to put less strain on that part. For example, about a decade ago when the Model S launched, there were worries that the battery pack could catch on fire if something on the road scratched under the vehicle deep enough. Tesla was able to send out an OTA update that slightly raised the car’s suspension — greatly reducing the amount of debris hitting the bottom of the car. This stopped reports of fires while Tesla developed a permanent solution — a thicker sheet of metal under the vehicle.

As you can see in Figure X below, no other car manufacturer has this level of OTA capabilities.

Performance

Forward Cap summed up Tesla's performance nicely, "You get the performance of a supercar with perfect safety ratings, ordered in a few minutes from your phone (without pesky car salesmen) for an affordable price."

Teslas have better acceleration than supercars 10X their price.

Safety

Tesla achieves elite performance while maintaining the best safety ratings of any vehicle. As Chaim Gartenberg of The Verge explains:

Model Y joins the Model 3, Model X SUV, and Model S in perfect crash test scores. (The Model S was originally granted a 5.4-star rating, before the NHTSA revised its guidelines to get rid of “impossible” scores.)

Teslas have the lowest probability of injury of any car tested by NHTSA since 2011.

In short, all 4 of Tesla's vehicles are the safest vehicles you can buy.

Sentry mode. Cameras can record. And you can project your voice over the Tesla's speaker from the phone app.

Reliability

Gas-powered engines cause friction, which causes them to degrade over time. They usually only last from 100,000 to 200,000 miles.

Electric vehicles are different, they don't use an engine and instead, use electric motors. Electric motors have very low friction, allowing them to last for much longer.

Electric motors typically last for 30,000 hours of use. This means that if you drive for 3 hours a day, your motors should run nearly maintenance-free for 30 years.

Tesla claimed to have tested the Model 3 motors for 1 million miles in their lab and it still looked like new.

The real test of reliability in an electric car is how long the battery lasts over time (battery degradation).

For the Model S and X, battery capacity retention averaged 88% after 200,000 miles. Only 12% battery degradation after the number of miles that a gas-powered car would need to be replaced. In short, a Tesla will still be running fine after the same amount of miles that a gas-powered vehicle would need to be entirely replaced.

This is why a Tesla car is a much better vehicle than a gas-powered car. Over the long term, the price of a Tesla is lower than a gas-powered car because the Tesla will last longer, require less maintenance, and electric charging is cheaper than gas.

Charging Speed

Teslas have the fastest charging speeds. Some other EVs have terrible charging speeds.

Tesla Model 3 and Ys have 250 kWh charging speeds. A Chevy Bolt has a 55 kWh charging speed. Tesla has about a 5X faster charging speed. The Chevy Bolt would take hours longer to charge on a road trip.

Resale Value

The Tesla Model 3 is at the top of the list of all vehicles for retaining resale value. And it is on track for having the best resale value of any vehicle ever.

Online Ordering

No dealing with shady car salesmen. You get your prices online and you're sure you're paying the same price as everyone else.

SuperChargers

The SuperCharger network is Tesla's solution to the range anxiety problem. No other vehicle manufacturer is making one. (Rivian said they would but they haven't started yet.) No company makes money from their charging network—it is essentially a 2 billion dollar expense with no return. But it is essential to making a good EV experience.

The Tesla SuperCharger network is (currently) only available to Tesla vehicles.

All other US charging networks have 4,282 locations and 8,464 charging stalls.

Tesla's US network has 1,430 locations and 10,000 charging stalls.

So isn't the non-Tesla charging better? They have more locations and almost as many stalls, right?

In short, no.

SuperCharger Charging Speed

There's a big difference between Tesla and non-Tesla chargers in terms of how much power the charger delivers (in kilowatts).

A 24 kW charger takes about 3 hours to charge a Tesla Model 3 from 0-100%. A 250 kW charger takes about 25 minutes. Think about it like this: Imagine if it took 3 hours to fill up your gas tank, now compare that to 25 minutes. It's a big difference.

SuperCharger Reliability

Tesla superchargers are reliable. Non-Tesla superchargers can be labeled as fast-charging but then take 20 minutes to give you a 1% charge – and the worst part is you only realize the charger doesn't work until after you've spent 20 minutes waiting.

Tesla superchargers are all owned by Tesla and their pricing rates are consistent. Other charging networks are often owned independently and the price rates of the charger are up to the owner of the charger. It would be like if your gas price was $3 at one gas station and $16 at another – there's no consistency.

Non-Tesla chargers are notorious for breaking. There is no warning. You have to drive to the charging stall and plug it in to find out if it's working or not.

You (virtually) have to sign up with every non-Tesla charging network to use a non-Tesla EV. Each separate network will require you to have an account with them to use any of their chargers. Imagine that every gas station made you sign up and give them your credit card info before they would let you buy gas.

SuperCharger Location

Non-Tesla chargers are not guaranteed to be in good locations. They could be far from normal trip locations, far from highways.

Tesla's superchargers are in good locations, have amenities, bathrooms, and are often near markets or places to get food.

Cost Advantages

Batteries

The lifetime cost of a Tesla is already on-par with a Toyota Camry, according to research from ARK Invest. In 2025, the cost of an EV will likely be lower than a Toyota Camry (much lower cost over its lifetime, due to the reasons below.)

No gas, no maintenance, batteries last longer than gas cars. Most gas cars start having serious problems from 100k-150k miles. EV batteries are completely different technology that can last far longer – 500k-1 million miles.

Batteries are the largest cost in electric vehicle manufacturing. Accounting for about 30% of the total cost to manufacture a vehicle.

The Limiting Factor

Batteries are the limiting factor in Tesla's vehicle production. They could make more vehicles if they could get more batteries.

Tesla has partnerships with Panasonic, CATL, and other battery manufacturers. They also are making batteries in-house at their Fremont factory. They have said that they will start a production line of their new battery architecture (4680) at their new Gigafactory in Texas.

Tesla has long-standing relationships with battery manufacturers and they are the largest customer of batteries. This means that Tesla is more likely to secure battery supplies in the future, something that will be much more difficult for smaller, less established car companies.

The CFO of Panasonic said in February 2022, "Tesla has put in an extremely strong request for the 4680, so when we are actually able to deliver the 4680, we plan to put top priority on Tesla."

Tesla's efforts in batteries will result in huge benefits, namely an estimated 54% increase in range and a 56% decrease in cost.

Battery Efficiency

Battery efficiency is an important factor in reducing costs. A more efficient battery allows a manufacturer to put fewer batteries into a vehicle, reducing cost and weight. Figure X shows that Tesla has the most efficient batteries.

Profit Margins

Tesla's profit margins are higher than any other car manufacturer. That means that they make more money relative to their costs to make vehicles than any other car manufacturer, including well-established manufacturers like Toyota and Ford.

This is, in part, because Teslas are sold directly from Tesla online. Traditional car manufacturers use franchised car dealerships that act as a middleman between the car manufacturer and their customers. The dealerships take a cut of the car manufacturer's profit.

Manufacturing Advantages

Automation

Tesla uses something that no other car manufacturer uses. Single piece Giga casting. The entire rear of the Model Y is cast in a single piece. I know this doesn't sound impressive, but it is. It greatly reduces complexity. Elon said that the machine removed 300 robots because of this innovation (fewer robots is better). Tesla plans to do the same for the front casting, which will remove another 300 robots. This allows Tesla to have more production lines in each factory.

Batteries

The 4680 battery architecture is a new architecture designed by Tesla specifically designed for EV performance.

Enigineering and Design

Unparalleled ingenuity. Cybertruck design cuts paint costs. The metal does not need to be stamped like a traditional curved car. Stamping the metal (the process manufacturers use to shape the metal on a car) is impossible to do on the Cybertruck. Its steel is too strong to stamp. This forced Tesla engineers to design a vehicle that is not stamped, only folded.

A new paint shop costs $500 million. Tesla is able to reduce the setup cost of every Tesla Cybertruck line by $500 million.

Flexibility

Tesla doesn't have yearly vehicle updates like traditional manufacturers. Rather, they constantly make minor tweaks to iterate and improve on the original design. They regularly update both software and hardware on their vehicles. This flexibility makes Tesla more apt to deal with supply shortages and software issues.

The Covid-19 pandemic caused factory shutdowns and supply shortages for all car manufacturers. Tesla was able to resume production faster than all other car manufacturers due to its flexibility. For example, Tesla has best-in-class battery engineers who were able to change the battery chemistry to avoid material shortages.

During the same time period, there were computer chip supply shortages. Once again, Tesla was able to use its ingenuity to develop software that allowed them to use different computer chips. This allowed them to continue to produce cars in difficult situations, unlike their competition. Ford, for example, shut down much longer than Tesla during the pandemic. Chinese EV manufacturers, Nio, Xpeng, and Li Auto, were also able to avoid chip shortages and keep production high despite the supply shortages and Covid-19 related shutdowns.

Attracting and Retaining Employees

"[Elon Musk has] an excellent nose for talent. And finding the people who can share his vision and then motivating them in a way where they feel like they are part of a mission. Like they are reaching for the stars, trying to do something impossible. And that they're all in it together." – Tim Higgins, preeminent Tesla reporter.

Tesla gives all of its employees stock options. This aligns the incentives of employees and the company. Each employee makes money if Tesla stock goes up.

Trillion Dollar S-Curves

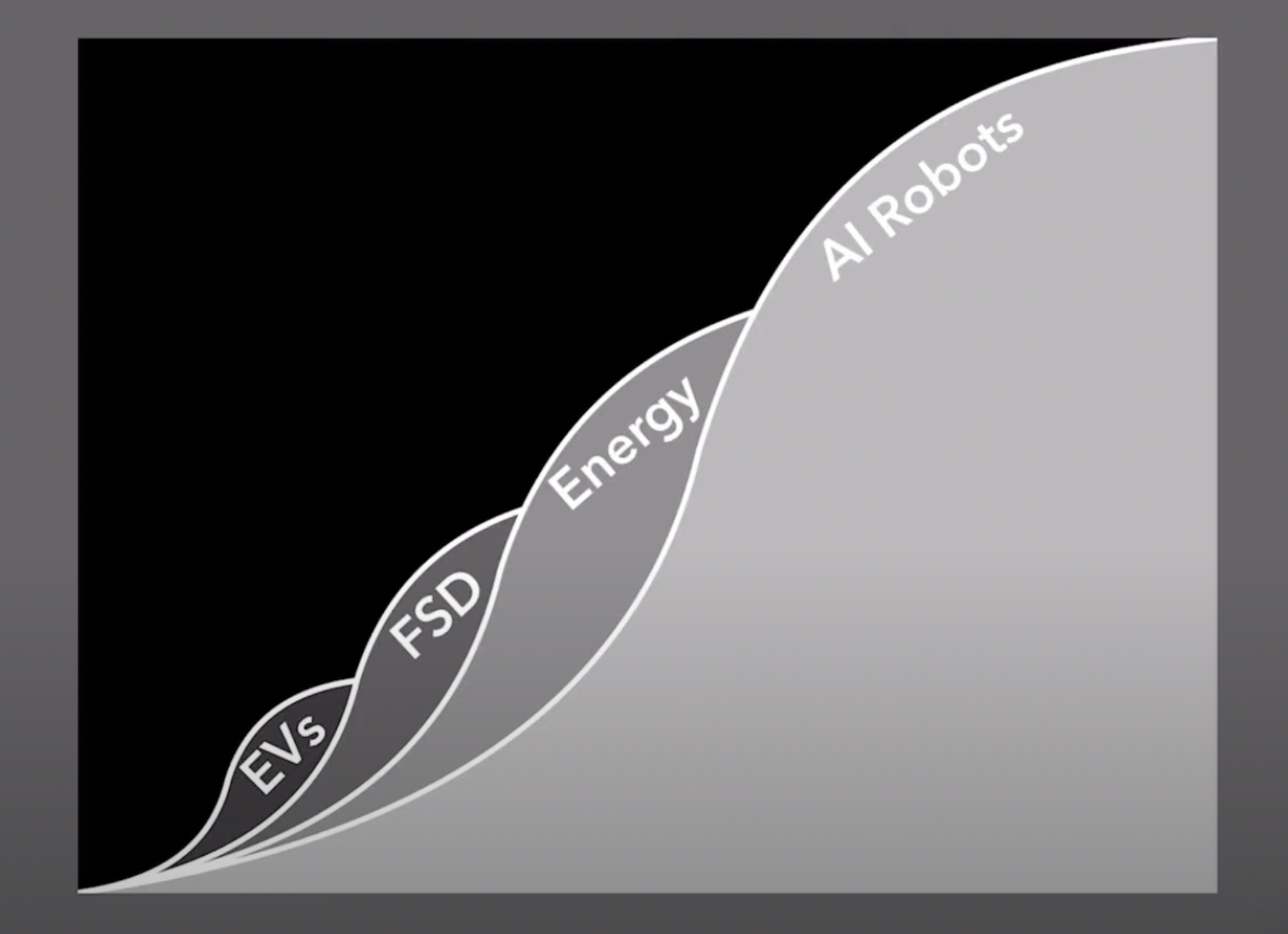

The analyst Dave Lee brought up the idea of Tesla's technology S-Curves. He identified 4 speculative catalysts: Electric vehicles, Full Self Driving, Tesla Energy, and the Tesla Bot.

Dave thinks that the electric car side of the business alone could make Tesla the largest company in the world by market capitalization.

Full Self Driving could take Tesla to 3-5X larger than EVs.

Tesla energy could be larger than the EV side of Tesla.

Tesla Bot. The Tesla Bot is a speculative bet. If successful, it could unlock tons of value. The Tesla Bot could take over boring, dangerous, and tedious jobs from humans. Tesla announced the Bot in August 2021 to attract robotic engineering talent. The Tesla Bot S-curve could take Tesla to 10-100X the market cap that FSD could take Tesla to. This would take Tesla to an incomprehensible valuation. This would require immense execution from the Tesla team. I'm not saying it's guaranteed, and I'm not even saying it's likely, but it is a possibility for Tesla in the long term.

Conclusion

Tesla's vertical integration in engineering, manufacturing, and design allows them to have more efficient batteries and motors. This leads to better range for their cars. Their mid-price cars become cheaper because they require fewer batteries to achieve the same range. The lower price, better range, and supercharger network make Teslas the best vehicle to buy. This allows Tesla to sell more cars. More cars = more data. More data = better FSD.

Tesla's virtuous cycle is difficult to copy and impossible to beat. They will be the first to achieve autonomous cars.

Should I buy Tesla stock?

Price Prediction and Risks (Insider Investor Exclusive)

Click "Subscribe now" below to continue reading.