InvestAnswers Key Takeaways (10/10/22-10/12/22)

“I still believe in a Fed Pivot. We have another 3.5 weeks until November 2nd.” — Luke Gromen

Disclaimer: None of the following is financial advice. Please do your own research.

October 10, 2022

Bitcoin Miner Analysis - Who Wins This Quarter? Oct 2022 Edition

Miners analyzed: Marathon (MARA), CleanSpark (CLSK), Riot (RIOT), Hive (HIVE), Hut 8 (HUT), Argo Blockchain (ARBK), Bitfarms (BITF), and Core Scientific (CORZ).

The Composite Score is based on 8 factors:

- Gainers (Expected ROI)

- Price/Book

- Market Cap/Exahash

- BTC Value as % Market Cap

- Stock Dilution

- Balance Sheet Risk

- Largest Distance from 52 Week High

- BTC Mined per Exahash

Composite Score Winners

- First Place: CleanSpark (CLSK)

- Second Place: Core Scientific (CORZ)

- Third Place: Hut 8 (HUT)

Composite Score Losers (Highest Risk)

- Argo Blockchain (ARBK)

- Marathon (MARA)

- Hive (HIVE)

October 11, 2022

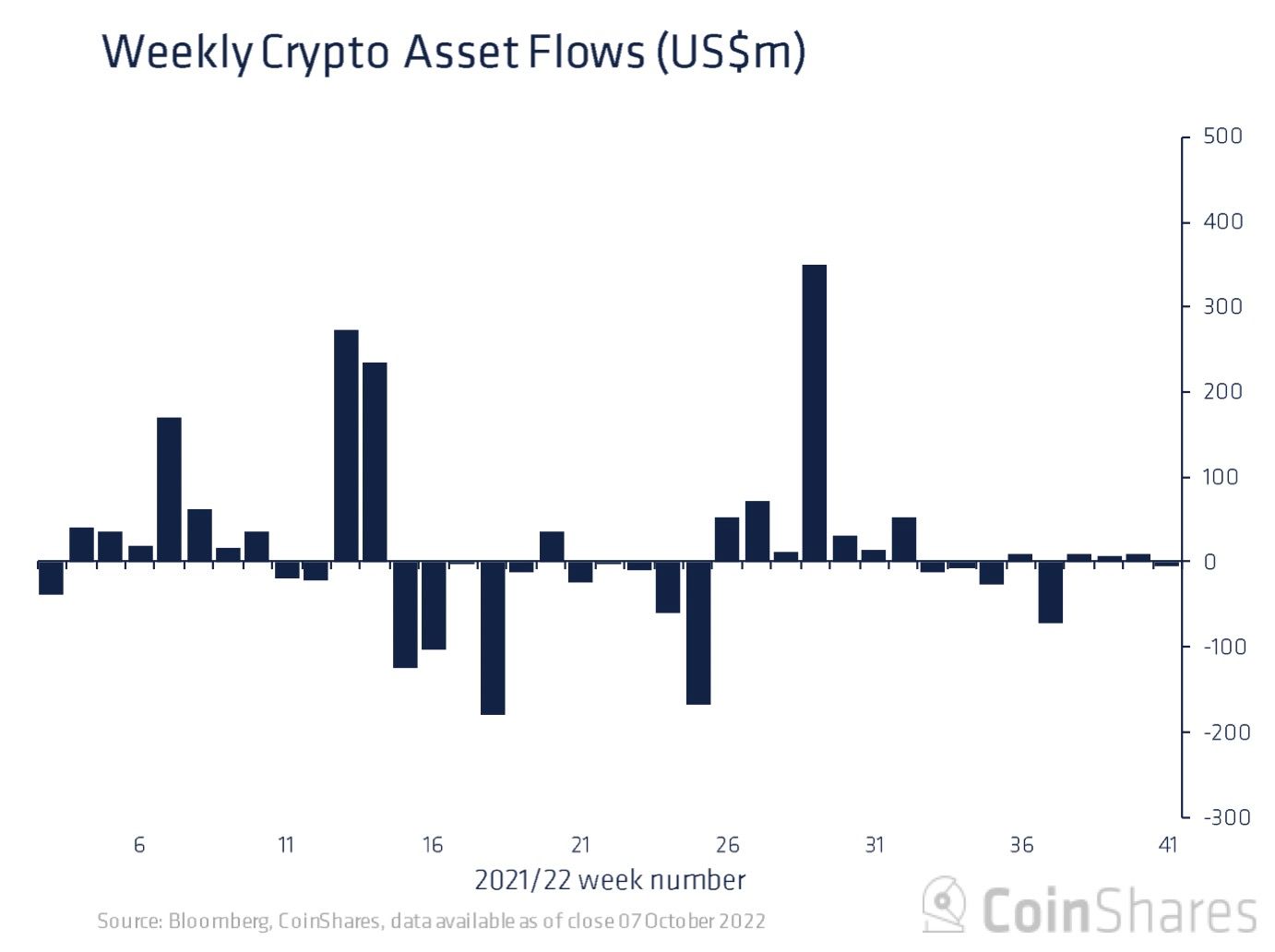

Crypto Market Uptober to Flat-Tober! What Happened?

The Good News

The $17,600 bitcoin price in June was likely the bottom. It should be flat or up from here unless there is a catastrophic macroeconomic event.

Important: The key group of bitcoin holders (whales with 1k to 10k BTC) have started buying. This is a bullish bitcoin price signal.

The Bad News

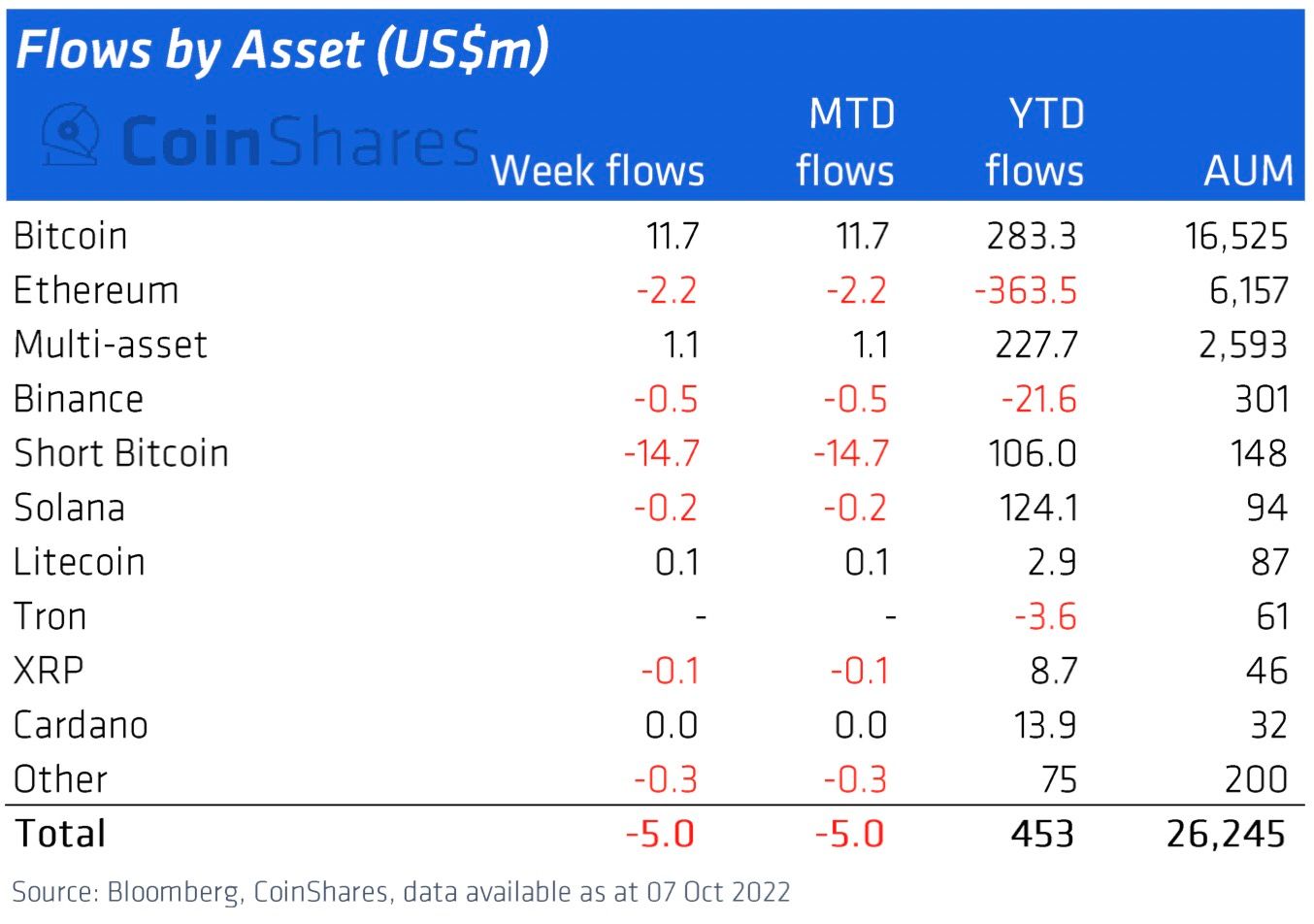

Institutional crypto money flow was negative for the first time in a month.

Institutional money flows by asset:

The Really Bad News

“When the central bank steps on the brakes, something goes through the windshield. The cost of financing has gone up and it will create tension in the system.” — Bob Michele, JP Morgan.

- The Fed is hurting the economy by hiking rates.

- YouTube Timestamp

Important: The Fed bond losses halt payments to US Treasury. The Fed is a nonprofit and gives its profits to the Treasury every year. But this year, the Fed has a lot of unrealized bond losses and will not have any profits to give to the Treasury. This means that the Treasury needs to get money from somewhere else. The Treasury will likely get it from Fed “money printing,” which would mean a Fed pivot.

October 12, 2022

Dollars, Liquidity, Petrodollar Challenges, and Bitcoin

“I still believe in a Fed Pivot. We have another 3.5 weeks until November 2nd.” — Luke Gromen (10/11/2022)

- “November 2nd” refers to the next Federal Open Market Committee (FOMC) meeting.

- Source

The real estate market has frozen. Mortgage rates have sharply increased. 70% of homeowners cannot sell their houses without having to refinance at a higher mortgage rate.

Companies and currencies hurt by Fed raising rates:

- Global recession

- Nike

- AMD

- Target

- FedEx

- British Pound Sterling (GBP)

- Yen

- Euro

US debt is $31.15T and growing. Realistically, the only way to reduce the US debt in real terms is with inflation (“money printing”).

The petrodollar is at risk because foreign countries are considering purchasing oil in currencies other than the US dollar. Brazil, Russia, India, China and South Africa (BRICS) are creating a digital currency. The BRICS digital currency (or bitcoin) could be used to purchase oil without having to use the US dollar.

We don’t know when a Fed pivot will happen. If the Fed raises rates another 75 basis points, it will hurt the economy. Unfortunately, it seems like it will raise rates another 75 basis points.

Comments ()