Bitcoin On-Chain Analytics

Yassine Elmandjra and David Puell recently published a framework to evaluate Bitcoin.

Yassine Elmandjra of ARK Invest and David Puell recently published a framework to evaluate Bitcoin. The following is based on their research.

What is Bitcoin On-Chain Analysis?

Bitcoin cannot be analyzed the same way that traditional assets are analyzed. It must be analyzed digitally, using on-chain data. On-chain data is the data on the blockchain. It is a somewhat technical to analyze on-chain data, this makes it difficult for some traditional finance analysts to understand Bitcoin.

Why does On-Chain Analysis Matter?

On-chain analysis is more accurate and transparent than any other type of analysis. All other analytics require you do trust a third party. If I want to check a market capitalization or stock price, for example, I have to rely on Yahoo Finance to show me accurate information. By contrast, on-chain analytics show information direclty from the source--you don;t need to rely on another insititution to give you accurate information.

There are many transactions in the stock market that go unknown--either its an individual who doesn't have to be disclose publicly or a company that only has to disclose at the end of the quarter. By contrast, with Bitcoin on-chain analysis, every transaction is immediatley made public for anyone to see.

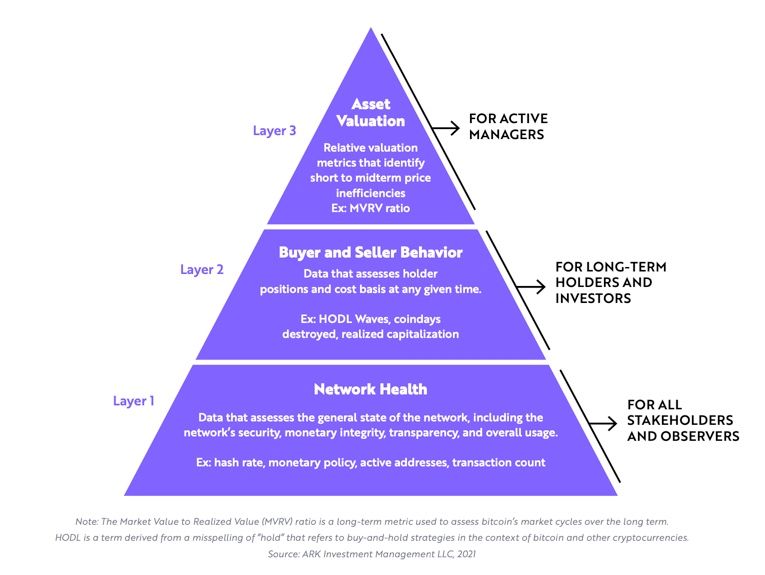

Elmandjra explains each layer of the pyramid:

Layer 1:

"The data in the bottom layer of the pyramid assesses the general health of the network: network security, monetary integrity, transparency, and usage. Accessed by any blockchain “search-engine,” the data in this layer is raw and straight-forward, requiring little to no manipulation. Relevant to all market observers, it offers a basic “fact sheet” about the network."

In short, this layer shows that the Bitcoin network is functioning properly.

Layer 2:

"The data in the middle layer delves deeper: by wallet address, it discloses each holder’s positions and cost bases at any time of the day. In the long-term, bitcoin’s price might react more to the raw health of the network as measured in layer 1, but analysis of buyer and seller behavior in the short- to medium-term can surface inefficiencies in the pricing and valuation of this non-productive asset."

In short, this layer shows the specific transactions of any Bitcoin wallet.

Layer 3:

"Finally, the top layer of data leverages off the two lower layers, providing relative valuation metrics that identify short to mid-term inefficiencies in bitcoin’s price. Particularly useful for active managers, the top data layer provides buy and sell signals in the crypto market, much like relative valuation metrics like EV-to-EBITDA in the public equities market."

In short, this layer helps crypto traders identify when to buy or sell.

Layer 1 In-Depth

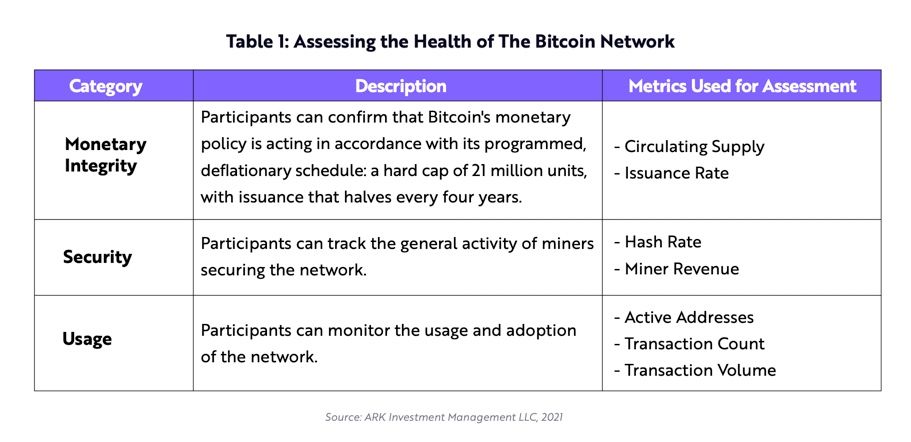

Monetary Integrity

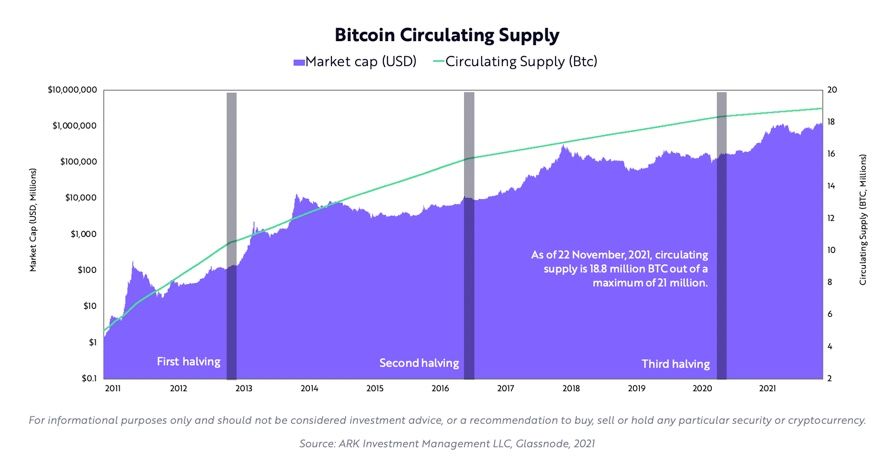

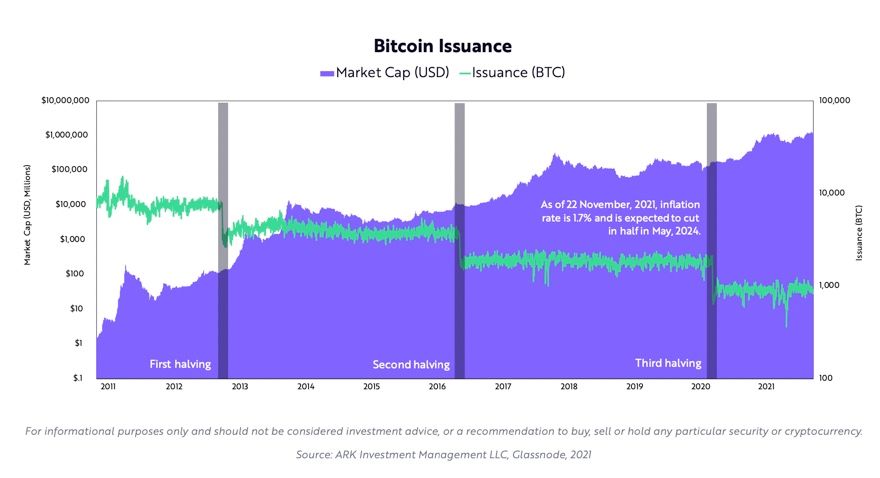

We can audit circulating supply and issuance rate. This gives analysts transparency on Bitcoin's monetary policy.

Bitcoin's issuance rate decreases over time. In the year 2140, all 21 million bitcoin will be mined, the issuance rate will be 0, and it will have a 0% inflation rate.

Security

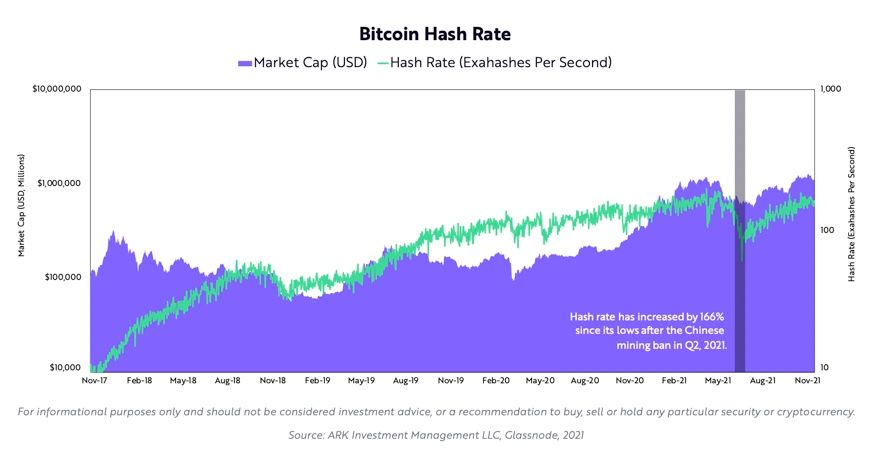

Bitcoin's security is based on bitcoin miners. Bitcoin miners use computing power to secure the Bitcoin network. Hash rate is a proxy for Bitcoin's network security. Hash rate is a factor of the computational power that miners have.

Bitcoin hash rate generally increases over time. There was a decrease in 2021 after China banned mining.

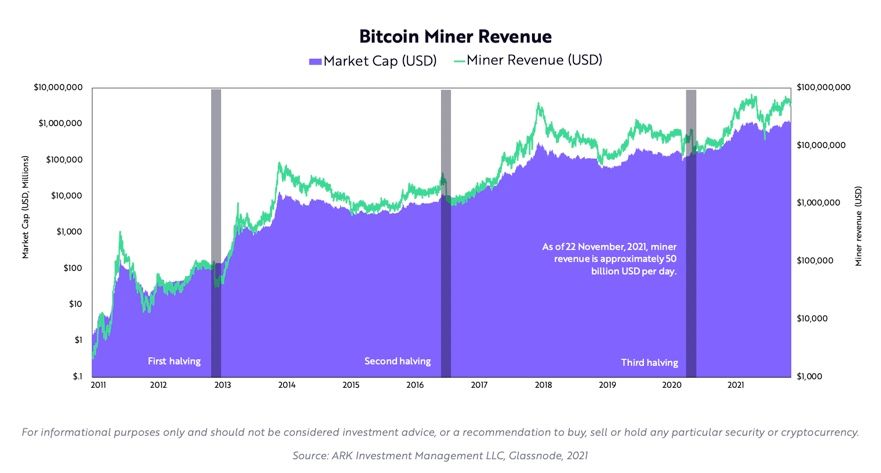

Mining is capital intensive. Miners need to buy state-of-the-art computers (called ASICs) and pay for electricity. To incentivise miners to mine, the Bitcoin network rewards them with newly minted bitcoin and transaction fees (users pay the transaction fees and they are given to miners).

Mining is a difficult but lucrative business. According to Elmandjra, miners have made revenue worth roughly $1 trillion since Bitcoin's inception.

Usage

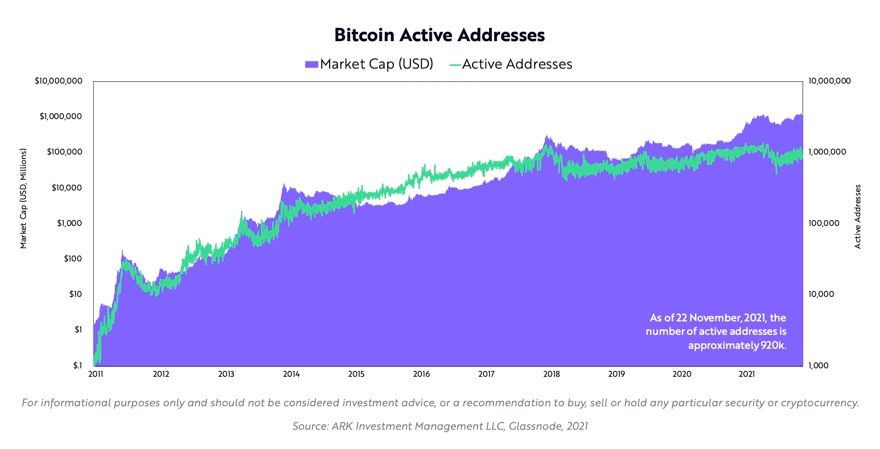

Bitcoin has roughly 920,000 active wallet addresses. This number is the best estimation we have for how many Bitcoin users there are. It is not a perfect metric because a single person could have multiple addresses and some addresses belong to companies.

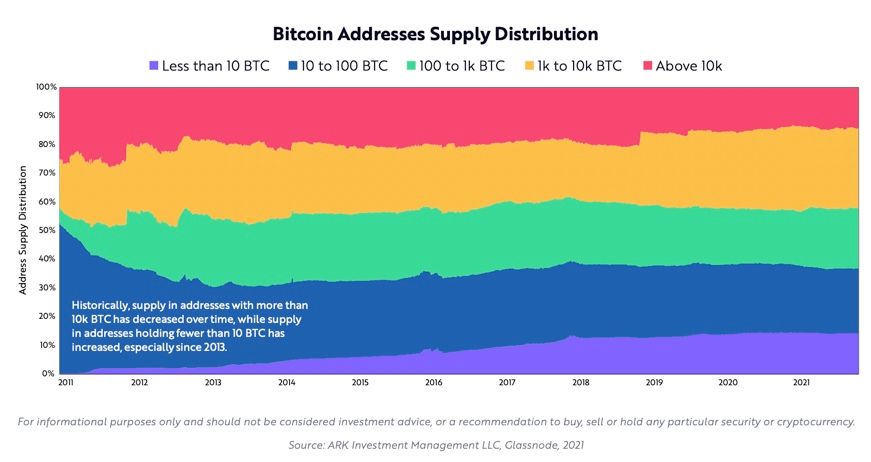

We can also use on-chain analysis to figure out how many Bitcoins each address has.

We can also analyze transaction count and transaction volume. These metrics represent the amount of bitcoin being transacted and the amount of bitcoin that has settled.

Layer 2

Bitcoins accounting system (the system Bitcoin uses to track transactions) is the unspent transaction output (UTXO).

Layer 2 shows us on-chain buyer and seller behavior metrics.

Elmandjra explains on-chain profit and losses: "Realized profits/losses measures the total USD value of bitcoins that are transacting at a profit or a loss. If a bitcoin transacts at a higher or lower price than the price at which it last moved, its subsequent move creates a profit or a loss, respectively. Periods of extreme volatility maximize profits and losses at market tops and bottoms, respectively, as shown below."

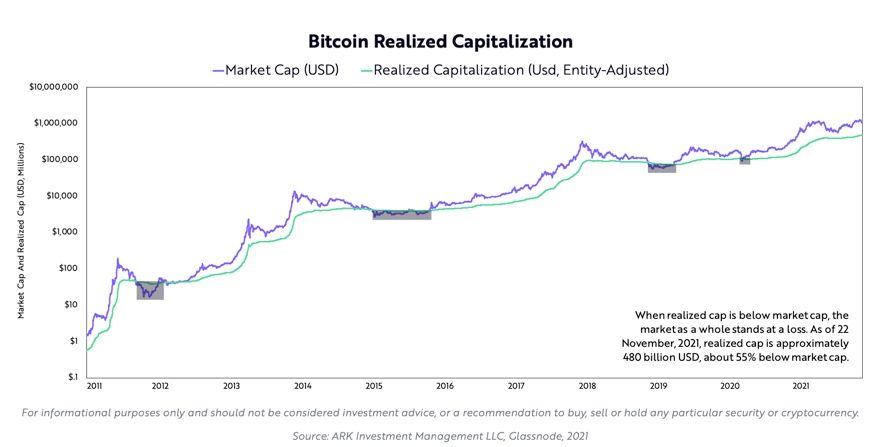

Elamandjra explains realized capitalization: "While market capitalization (market cap) aggregates the value of all bitcoins in circulation at current prices, realized capitalization (realized cap) is their average cost basis, valuing each bitcoin at the price of its last movement. Whenever market cap drops below realized cap, the overall bitcoin market is selling at a loss, suggesting capitulation. Today, bitcoin’s market cap is roughly $1 trillion, more than double its roughly $480 billion in realized cap, as shown in the next chart."

Layer 3

In this layer, we largely compare the metrics from layer 2 to the market value of bitcoin. This gives us an understanding relative to price of our analysis from layer 2.

Some of the metrics covered are Bitcoin MVRV ratio, Bitcoin MVTV ratio, investor capitalization, SLRV ratio, and more. Elmandjra goes more in-depth in his whitepaper. These metrics are useful for more advanced bitcoin investors.

Comments ()